1. DR/DNA

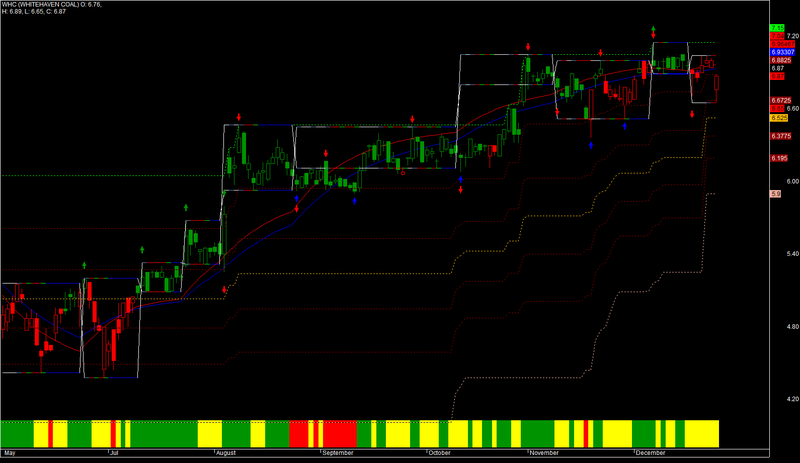

AmiBroker is not available for iPad but there are plenty of alternatives with similar functionality. The most popular iPad alternative is MetaTrader, which is free.If that doesn't suit you, our users have ranked more than 50 alternatives to AmiBroker and 14 are available for iPad so hopefully you can find a. AmiBroker Split 2017 complete edition With Spot can be allow you to manage all real time charts. With the help of this plan you can simply glue and eliminate all drawing objects, zoom in, zoom out, reduce, copy, resize, plants, move and much more. AmiBroker Split 2017 Total Version will be an incredible software. Category: Windows Tags: amibroker 6.20 1, amibroker 6.20 1 rar, amibroker 6.20 crack download, amibroker 6.20 download, amibroker 64-bit crack, amibroker for mac crack, amibroker free. download full version, amibroker india crack. AmiBroker on an Apple Mac (OSX) AmiBroker is a Windows application and does not have native Mac version, however we do have many Apple Mac users, who use Parallels (www.parallels.com) virtualization software in order to run AmiBroker on Mac and AmiBroker works perfectly fine in such configuration.

Data Reader and Discrete Noise Analyzer reads financial information from websites like StockCharts or Yahoo! and draws price charts. Supported indexes are: DJIA, SPX, COMPQ, VIX etc. Overlays are: Weighted Moving Average, Standard Deviation, Volume and Spectrum.......

Amibroker Alternatives For Mac Catalina

2. QCharts

QCharts offers reliable, streaming market quotes, charts and news, as well as extensive research and options analysis tools.......

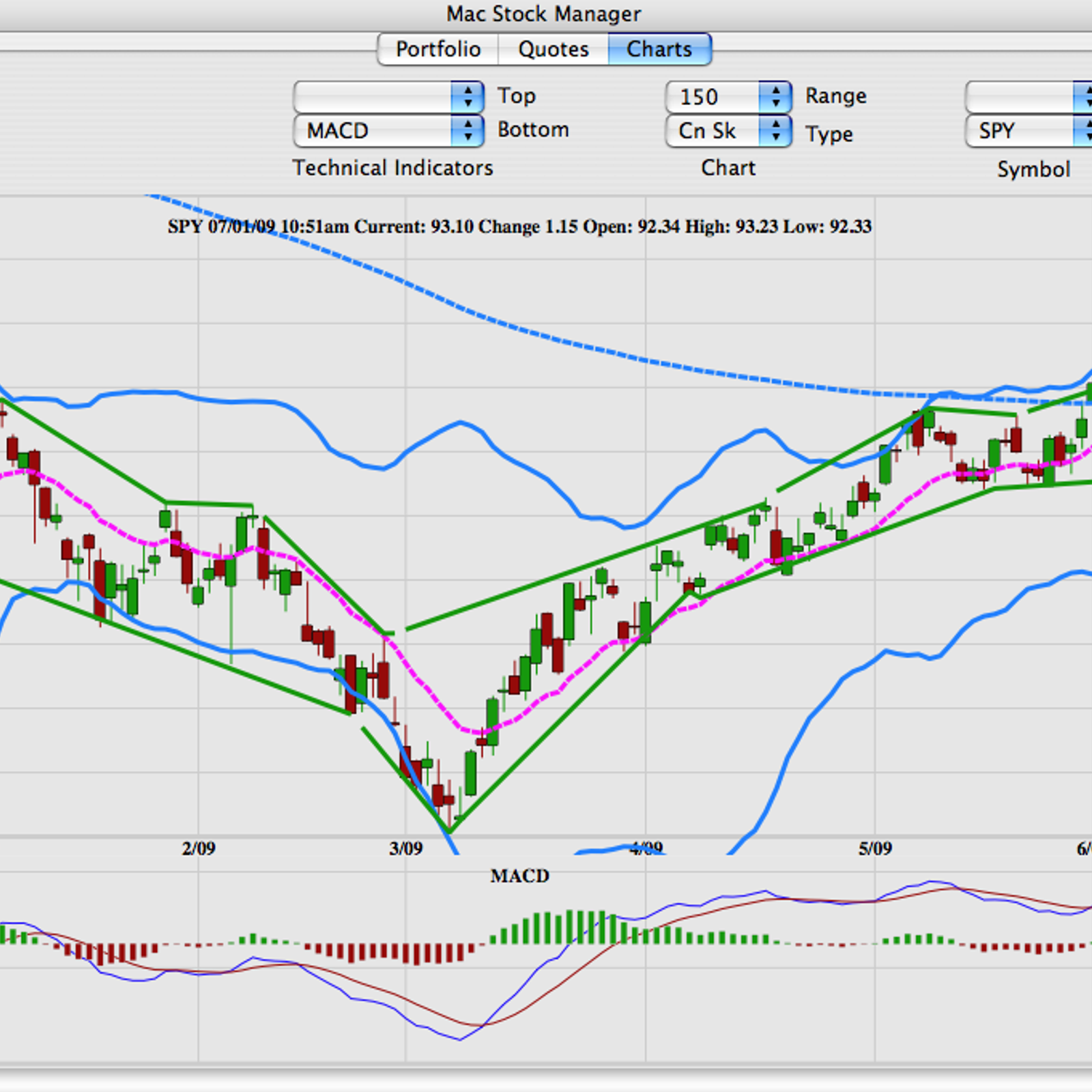

3. MacStockManager

Amibroker Alternatives For Mac Operating System

MacStockManager provides stock portfolio management, live quotes, and stock charting including 16 modifiable technical indicators. The stock portfolio, allows unlimited number of entries, 5 different accounts, supports stocks mutual funds, options and ISOs buying and selling including short sells. Numerous stock statistics are displayed including current day and total gains/losses.......

4. StockNerd

StockNerd is a free stock & portfolio tracking app for people who prefer to buy and hold their investments long term.Features- Track stocks, tickers, ETFs, & index mutual funds.- Create and track your own investment portfolio and see how it performs over time.- Compare your investment portfolios to others.-......

5. TickInvest

A complete and low cost stock charting software with all required features for technical traders and system trading developers. Use the trading simulator or backtester to analyze new strategies. The stock screener helps you to find new stocks and stock alerts warns you when you should exit. All features are......

6. PTMC | Protrader Multi-Connect

PTMC is a professional trading platform that combines all the best charting and analytical functionalities, which gives traders more ways to reach the right trading decisions on different markets. Connection via FCMs allows traders to use all platform’s features: - volumetric analysis, - different chart types (Cluster, Market Profile, Candles,......

7. SIG

The Stock Investment Guide (SIG) software provides powerful fundamental analysis of publicaly traded companies. SIG provides users with easy-to-use tools to analyze historical growth trends, project earnings and sales, and develop buy, hold, sell price targets. Increase your confidence as an investor. Understand the value of your stock investments. Increase......

8. ProTA

ProTA is professional level charting and technical analysis software exclusively for Mac OS X. ProTA is state of the art market charting, technical analysis and portfolio tracking for the stock market, mutual funds, futures and options markets. Professional technical analysis ProTA Gold adds custom indicators, trade modeling, system back-testing, parameter......

9. Sierra Chart

Sierra Chart is a professional Trading platform for the financial markets. Supporting Manual, Automated and Simulated Trading.......

10. Interactive Brokers

Interactive Brokers LLC is a member of NYSE, FINRA, SIPC. Interactive Brokers Group (IB Group) and its predecessor companies have been building trading technology for 38 years. IB Group consolidated equity capital exceeds $5 billion following the payment of a special cash dividend of approximately $1 billion pre-tax.'Create technology to......

11. TraderStar

TraderStar is designed for a broad range of users, from stock exchange professionals to novices in this area. Traders can use it for high-level technical analysis:- Regular users can use it to achieve their goal of financial stability- Programmers can use it to write their own indicators in Java-script -......

12. StockMarketEye

Track your investment portfolios and monitor the stock market with our easy to use software, including stock charts and free quotes. Track your actual portfolios or create virtual portfolios. Enter dividends and view Total Return. Compare portfolio performance. See what effects a change to your portfolio will have before you......

13. Robinhood

Robinhood is a new way to invest in the stock market. For......

14. Stockflare

Stockflare helps anyone pick stocks, easily. Investing doesn’t have to be complicated. We cut through hundreds of metrics for over 42,000 stocks globally. We rate and provide information on every stock. Protect what you’ve saved and grow it.......

15. Finance Toolbar App

Access real-time stock information and0003 investment updates to stay on top of the0003 market.This app shows on your desktop a dynamic scrolling bar with the latest stock information.......

With the way the market has been acting, I think it makes the most sense to buy on dips unless the price action changes.

Of course, there’s the debate tonight, but I believe the catalyst that most traders will be focused on is the potential stimulus.

When it comes to large-cap momentum stocks, there are actual risk-defined strategies that allow you to establish your bullish or bearish opinion.

Especially in this market environment, I believe it’s important to keep my options open because it can help stack the odds to my favor.

Let me show you some cheaper alternatives to “buying the dip”, and why I believe it makes sense to consider these strategies if I find a large-cap momentum stock that can take off.

Alternatives To Trading Large-Cap Momentum Stocks

Listen, I get it… large-cap stocks are expensive. I used to believe that because they’re expensive, I couldn’t join in on the action.

However, there are actually cheaper alternatives out there.

What do I mean by that?

Well, options provide leverage and there are plenty of unique ways to utilize them to make money.

For example, on Monday, I sent this out to subscribers.

Nice wins on AAPL to end last week. I’d arrived to that trade a week or so too early or it’d been a monster win. Once AAPL starts trending though, which is probably happening now, due to the iPhone rumored in October, I’ll be jumping right back in. AAPL is at about $115 this morning so I left a lot and I mean a lot ($160K potential) on the table but because I arrived to the trade too early, I felt with a week to go on the big position it was too risky for my appetite. Bottom line, I was right but slightly miss timed the entry and therefore got a small $28K win versus what wouldn’t have been significantly more.

AAPL at $112-$110 on any dips this week interests me, AMZN $3100 / $3190 and TSLA $410 / $400 as well. Bull puts across the board as speculation over a stimulus deal is favorable right now.

That said, I don’t want to chase moves, but I am mindful of a trend starting so I don’t want to be super stubborn about waiting for a dip either. I will take smaller positions and try to run with the bulls here as long as they can control the trend. A big thing that’s happening this morning is the QQQ is taking back the 21 EMA, that’ll be really important to monitor for decision making.

So let’s use Apple Inc (AAPL) as an example. I want to look around the $110 to $112 area for a potential play to the upside.

You see, around that area, there are key moving averages. The 8-day exponential moving average (EMA) is right around $112, and the 55-day EMA is just under $110.

Since I believe that area can hold up as a support level, I want to get in around there.

Amibroker Alternatives For Mac High Sierra

Of course, since the stock is above $100 a share, it’s pretty expensive. The simplest alternative is to buy calls. The deeper in the money (ITM), the more expensive. The opposite is true for deeper OTM options.

So let’s say I think AAPL can get to $125, I might look to buy the at-the-money (ATM) calls because they’re cheaper than the deep ITM calls, and the odds are better than deep OTM calls.

The thing is, selecting strike prices and target areas, as well as expiration dates, can be a little tough if you’re new to the options game.

Another approach would be to utilize a bull put spread.

This strategy actually involves selling OTM puts, and simultaneously purchasing deeper OTM puts (to hedge the short put position).

I get it, it’s tough to grasp at first.

The way it works is, I identify areas in which I believe a stock won’t go below within a certain time frame.

For example, let’s say I don’t believe AAPL can get and stay below $105 by next Friday.

Well, I can look to sell the $105 puts, while simultaneously purchasing the $100 puts.

Amibroker Alternative For Mac

This way, if AAPL stays in range, runs higher, or even drops a little… I would be in a position to win.

Over time, the time decay would eat at those puts, and I would collect a premium for that. The closer AAPL gets to expiration (if it’s above $105) they would lose a lot of value… and I would collect a bulk of the premium.

Best Afl For Amibroker

Depending on my risk tolerance and conviction on a specific trade, I might look to buy calls or use the bull put spread, if I want to “buy the dip”.